From the stock market to business closure: Here’s how the COVID-19 pandemic is affecting the economy

Photo by Mark Finn

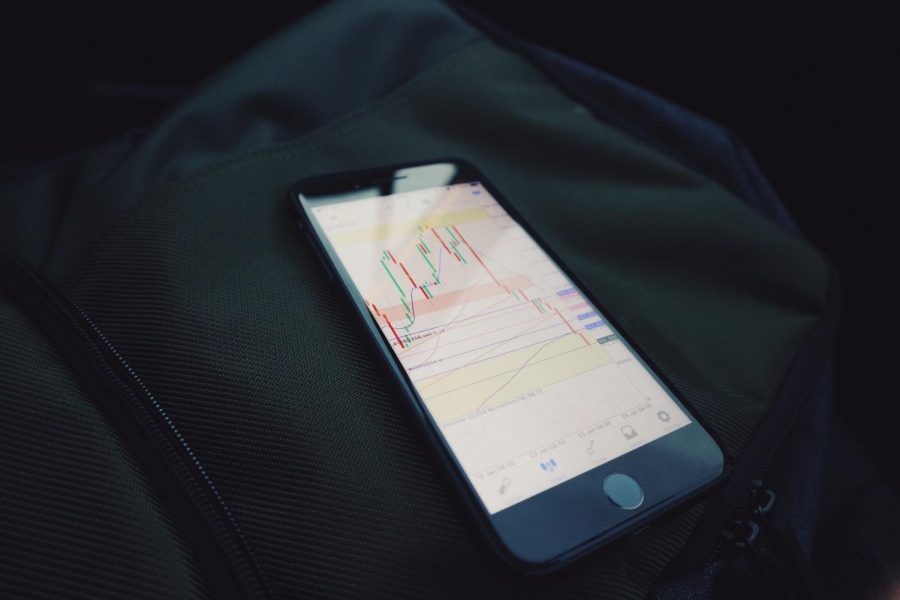

COVID-19’s economic repercussions are severe. On a sunny day in downtown Naperville, the relatively empty sidewalks and streets make it clear that money is being lost in what was a lively hotspot for restaurants and stores no less than a week ago. COVID-19’s impact on the stock market could have the United States. heading toward a recession, while its immediate human impact lies in the millions whose jobs are threatened by the pandemic.

On a national economic scale, the Dow Jones stock market index had its biggest point drop of all time on Monday and third-biggest percentage drop, the largest since 1987. Many investors and experts are worried that this is an indication of an oncoming recession, not only for the U.S. but for the world, as global markets tumble. Shannan Healy, a sophomore at North, is not optimistic about the economic impacts that the virus will continue to have in the future.

“Based on what I’ve seen, the virus is not going away for quite some time and it could take even longer for the stock market to go back up. This puts a lot of stress on my family, especially my parents’ jobs, and it could continue to financially affect students my age as we go into college,” Healy said.

Only about 55% of Americans own stock, so the threat of a possible recession is not yet as dangerous to some as lost income from not working and the resulting uncertainty of paying bills in the midst of this pandemic.

In Illinois, Gov. JB Pritzker announced on Sunday that all restaurants will be closed to dine-in customers until March 30, adding food service employees to the growing list of people whose sources of income are in danger as a result of the coronavirus. Hospitality industry workers and airlines have also taken a hard hit as domestic and international travel continue to decrease, in part due to President Donald Trump’s Europe travel ban. The airline industry as a whole is asking the federal government for over $50 billion in aid as a result of the damage to their sales, joining the casino industry in seeking financial help from the federal government.

As of Monday, the governor also issued an executive order in line with the CDC’s recommendation to limit gatherings over 50 people. This order applies to fitness centers, privately owned clubs, theaters and other entertainment venues. However, it will not affect hospitals, grocery stores, gas stations, shelters or banks. The order, while in an effort to keep people safe, means more lost income, a move that could prove disastrous for low-income workers in Illinois.

Pritzker issued a disaster proclamation on March 9 that opened up the ability to use the State Disaster Relief Fund, which could go to supporting those unemployed by the virus. On March 11, the Pritzker administration issued a press release saying that workers impacted by the coronavirus could receive unemployment benefits to the full extent of the federal law, which could help ease the burden on the growing number of people financially affected by COVID-19.

With Americans buying up large amounts of groceries in preparation for quarantine, low-income people who rely on the Supplemental Nutrition Assistance Program — food stamps — may be disproportionately affected, as their financial assistance allows only for the purchase of certain types of food that fall under federal guidelines. If these products are bought up at grocery stores, that could mean a shortage of food for people already in difficult financial positions.

The federal government is working to provide some leniency in the quality control interviews for SNAP, which can now be done over the phone for greater social distancing if states opt into it. The program is aimed in hopes of continuing access to federal assistance for Americans who need it. As of now, Illinois has not notified the federal government’s Food and Nutrition Service that it will implement this flexibility in interviews.

On top of losing jobs and potentially losing access to food, with no federally mandated paid sick leave days, some Americans could also be losing money by staying home as a result of the coronavirus. Congress’ emergency coronavirus relief package, which addresses this issue, passed in the House of Representatives and is moving to the Senate. The package implements requirements regarding paid sick leave but has exemptions that could still mean no paid sick leave for almost 20 million workers.

While the government tries to balance the health and financial consequences that the coronavirus poses, United States industries, companies and individuals are currently on the economic decline. In the future, the millions of financially affected Americans will continue to look to their local, state and federal governments to manage the fallout of this unprecedented global crisis.

Reyah is a senior at North and is excited to take on the role of Editor-in-Chief in her third year writing for The North Star. This year, she hopes to...