In-depth: Navigating the treacherous trap of student debt

As hundreds of Huskies graduate each year, the potential threat of forthcoming student debt looms on the horizon.

Student debt is an increasingly pervasive issue in the United States. According to Forbes, over 44 million Americans are plagued by student loan debt. Nationwide, student debt totals at $1.3 trillion, making it the second largest consumer debt sector behind only mortgages.

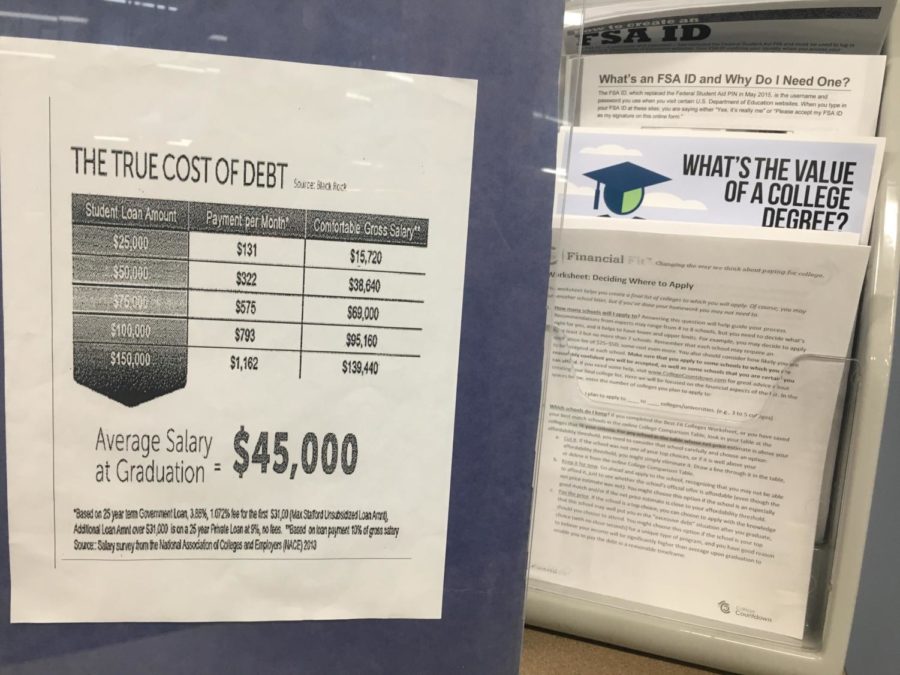

Just as harrowing was a recent report by the Federal Reserve Bank (FRB) of New York, which documented a $14,000 leap in average student debt per person from 2005 to 2015. According to the FRB, the average class of 2015 college graduate owes $34,000 worth of debt.

Debt has grown in the wake of close to 200 percent jumps in tution over two decades for both in-state and out-of-state public universities, as reported by US News. Growing unemployment among 25- to 34-year-olds, increased availability of financial loans and an increase in college attendants from lower-income families (who tend to need to take out more in loans) are additional causes of the rise in total student debt accumulation.

Paying for college may seem like a daunting task. However, there are many ways for high school students to minimize or even avoid excessive debt once they go to college. A strategic approach to paying for college as well as an early start on planning can mean the difference of thousands of dollars in debt.

NNHS College and Career counselor Brian La Porte stressed the importance of planning ahead when making a decision on which college to attend and advised students to consider not only tuition costs, but the cost of rent, groceries, travel, books and other expenses associated with college.

According to La Porte, the first thing students should consider doing when preparing to pay for college is to fill out the Free Application for Federal Student Aid (FAFSA) if they feel they would qualify. Filling out a FAFSA can enable students to put themselves in the best financial situation. Over half of NNHS students apply for FAFSA and receive financial aid.

In many cases, however, filling out a FAFSA may result in loans, which can burden students throughout their college careers.

Whether or not an applicant receives financial aid from FAFSA depends on the applicant’s year in school, enrollment status, the Expected Family Contribution (EFC) and the estimated total cost of college attendance which includes costs of tuition, room and board, books and supplies, transportation and other miscellaneous fees. The EFC is a calculation of a family’s income and the number of family members attending college during that year. Financial need is determined by subtracting expected family contribution from the estimated college attendance costs.

If a student is not eligible for need-based financial aid, FAFSA may offer the applicant loans or grants.

Steve Harrison, a financial adviser for the 360 Financial Group in Naperville, warned students against taking out more loan money than they need. People from more affluent backgrounds, Harrison said, should be especially mindful of this because they may not necessarily need to take out a lot of loan money in order to afford college and they also may not be offered much need-based financial aid.

“You just tack on a lot of toxic debt that you don’t need. It’s enticing, [but] you want to stay away from that,” Harrison said. “A loan is a potential pitfall.”

Taking out loans for college can still be beneficial for many students. The two main types of loans are subsidized and unsubsidized. Subsidized loans are based on financial need and usually do not have interest while a borrower is still in school or during a deferment. Unsubsidized loans acquire interest for the entire duration of the loan and anyone can take out an unsubsidized loan, regardless of financial need.

Subsidized loans may appeal to students because borrowers won’t be charged as much interest as they would with an unsubsidized loan, Harrison said. However, he explained, students who get subsidized loans may end up with excessive amounts of money that they’ll have to pay back after college.

“Because [of] the way that they set themselves up, [college students have] accumulated a lot of debt along the way, and with a subsidized loan, that’s just one more loan that’s piled up,” Harrison said.

According to Harrison, graduates who are financially unable to pay more money earlier on in their education and career tend to benefit from subsidized loans, while those with more financial stability should consider unsubsidized loans. Students with a knack for planning and budgeting may also prefer unsubsidized loans.

In addition to federal financial aid, various types of scholarships can play a significant role in how much money students can save on college expenses. La Porte encouraged students to apply to any scholarship they’re eligible for. Seemingly small sums of scholarship money, La Porte said, can add up and minimize college payments considerably.

“A lot of times, students are surprised at the money that’s out there,” La Porte said.

Scholarship money can make significant differences in a college student’s financial situation. Clara Holder, a sophomore at the University of Minnesota, urged students to continue applying for scholarships even after their first year at college. Doing so, Holder found, was very helpful in her college career thus far.

Students should consider money they may receive in financial aid, scholarships as well as seemingly minor college-related expenses, along with the price of tuition.

According to La Porte, a student should map out all the costs accompanying a college as well as the money they could receive in scholarships, and decide on which college to attend accordingly.

“When it comes down to it, a lot of it is simple arithmetic,” La Porte said.

Less than a quarter of his clients from the Naperville area were college students taking out loans for themselves, Harrison said. More commonly, parents open savings accounts for their kids.

La Porte encouraged students to involve their parents in their college decisions. It’s common for students from the Naperville area to rely on their parents in the process of paying for college. A student in this situation should discuss college closely with their parents as their parents will likely have a large amount of control over their child’s financial situation during and after college.

Harrison and La Porte also encouraged current high school students to consider less traditional post-secondary paths, such as attending community college for a few years before transferring to a more prestigious university. This way, students are able to complete general education courses for a much lower price.

“Looking at a community college is an amazing opportunity that students have that they maybe don’t appreciate,” La Porte said.

Emily Welp is a senior at Naperville North High School and is returning for her second year on The North Star staff and her first year as features editor....

David Wilson • Nov 14, 2018 at 6:45 am

Great article on student loans. I think getting student loans in the USA is finding new issues for lenders due to the income source that seemed to be not sufficient after a student completes their course of study. This is due to the fact that every student was unable to find a suitable job later. Eventually causing debt consolidation. Governments are making some useful policies addressing these issues to find a way to clear the student loans easily by taking more time to repay or waive off some amount. Maybe to some extent other types of loans like Personal, Payday loans can help them fulfill their daily routine in case the student cannot pay their debts. But, these need to be taken wisely, not desperately. So, to find the best lender in the market, it is good to take the help of financial service providers such as short term credit who provides more funding options to choose from to match the requirement and purpose.

https://shorttermcredits.com/quick-installment-loans-for-bad-credit.php